Unlocking Financial Analysis: A Comprehensive Guide to Mastering the IRR Function in Excel

Introduction: In the dynamic world of financial analysis, Excel serves as an indispensable tool for evaluating investment opportunities, assessing project feasibility, and making informed business decisions. Among the plethora of financial functions available in Excel, the Internal Rate of Return (IRR) function stands out as a powerful tool for calculating the rate of return on investment projects. Whether you’re analyzing cash flows, comparing investment alternatives, or determining project profitability, mastering the IRR function can significantly enhance your financial modeling capabilities. In this comprehensive guide, we’ll delve into the intricacies of the IRR function in Excel, exploring its syntax, practical applications, and advanced techniques to help you become a financial analysis virtuoso.

Understanding the IRR Function: The Internal Rate of Return (IRR) function in Excel is designed to calculate the rate of return on investment projects based on a series of cash flows, including initial investment and subsequent cash inflows and outflows. The IRR represents the discount rate at which the net present value (NPV) of all cash flows equals zero, indicating the rate of return that makes the project financially viable.

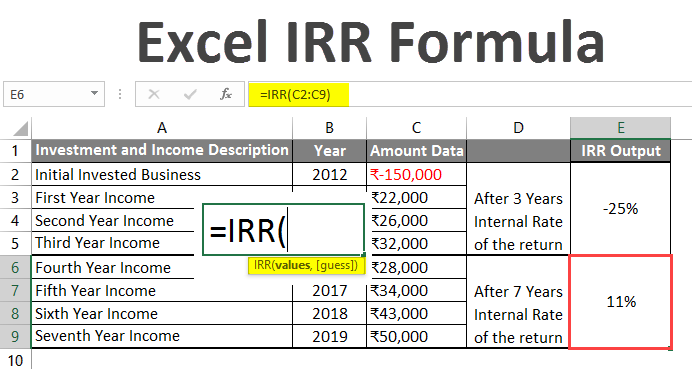

Syntax of the IRR Function: The syntax of the IRR function is as follows:

=IRR(values, [guess])

Here’s what each argument represents:

- “values”: The range of cash flows, including the initial investment and subsequent cash inflows and outflows, represented as a series of values.

- “[guess]”: Optional. An initial guess at the rate of return. If omitted, Excel uses 0.1 (10%) as the default guess.

Practical Applications of the IRR Function: Now, let’s explore some practical scenarios where the IRR function can be invaluable:

- Investment Analysis: The IRR function is commonly used to evaluate investment opportunities by calculating the rate of return on capital investments, such as equipment purchases, real estate developments, or business expansions. By comparing the IRR of different investment alternatives, decision-makers can assess the relative attractiveness and profitability of each option.

- Project Evaluation: In project management, the IRR function can be used to assess the financial viability of capital projects by calculating the rate of return on project investments. Project managers can use the IRR to determine whether a project is expected to generate sufficient returns to justify the initial investment and meet financial objectives.

- Capital Budgeting: The IRR function plays a crucial role in capital budgeting decisions by helping companies allocate financial resources effectively and prioritize investment projects. By calculating the IRR of potential projects, financial managers can identify projects with the highest expected returns and allocate resources accordingly to maximize shareholder value.

- Financial Modeling: In financial modeling and forecasting, the IRR function is used to analyze the financial implications of various scenarios and assess the sensitivity of investment decisions to changes in key assumptions, such as revenue projections, cost estimates, and discount rates. By incorporating the IRR into financial models, analysts can evaluate the impact of different factors on project profitability and make informed decisions.

Best Practices for Using the IRR Function: To make the most of the IRR function, consider the following best practices:

- Ensure Consistent Cash Flow Timing: When using the IRR function, ensure that cash flows are entered consistently, with positive values representing cash inflows and negative values representing cash outflows. Inconsistent cash flow timing can lead to erroneous IRR calculations and inaccurate investment evaluations.

- Validate Results with Sensitivity Analysis: Perform sensitivity analysis to assess the robustness of IRR calculations and evaluate the impact of changes in key assumptions on project profitability. By varying input parameters such as cash flow amounts, project duration, and discount rates, analysts can identify potential risks and uncertainties and make more informed investment decisions.

- Consider Limitations and Assumptions: Recognize the limitations and assumptions inherent in IRR calculations, such as the assumption of reinvestment at the calculated rate of return and the potential for multiple IRR solutions in complex cash flow scenarios. Exercise caution when interpreting IRR results and consider using complementary financial metrics, such as net present value (NPV) and payback period, for comprehensive investment analysis.

- Use Error-Handling Techniques: Implement error-handling techniques, such as IFERROR or ISERROR functions, to handle potential errors or irregularities in IRR calculations gracefully. By incorporating error-checking mechanisms into Excel formulas, you can ensure the reliability and accuracy of financial analyses and avoid misleading results.

Conclusion: The Internal Rate of Return (IRR) function in Excel is a powerful tool for evaluating investment opportunities, assessing project feasibility, and making informed financial decisions. By understanding its syntax, practical applications, and best practices, you can leverage the IRR function to enhance your financial analysis capabilities and gain valuable insights into investment performance and profitability. Whether you’re a financial analyst, business manager, or entrepreneur, mastering the IRR function is an essential skill that will empower you to navigate complex investment decisions with confidence and precision, ultimately driving success and growth in your organization.